Supplemental Pay

What is supplemental pay?

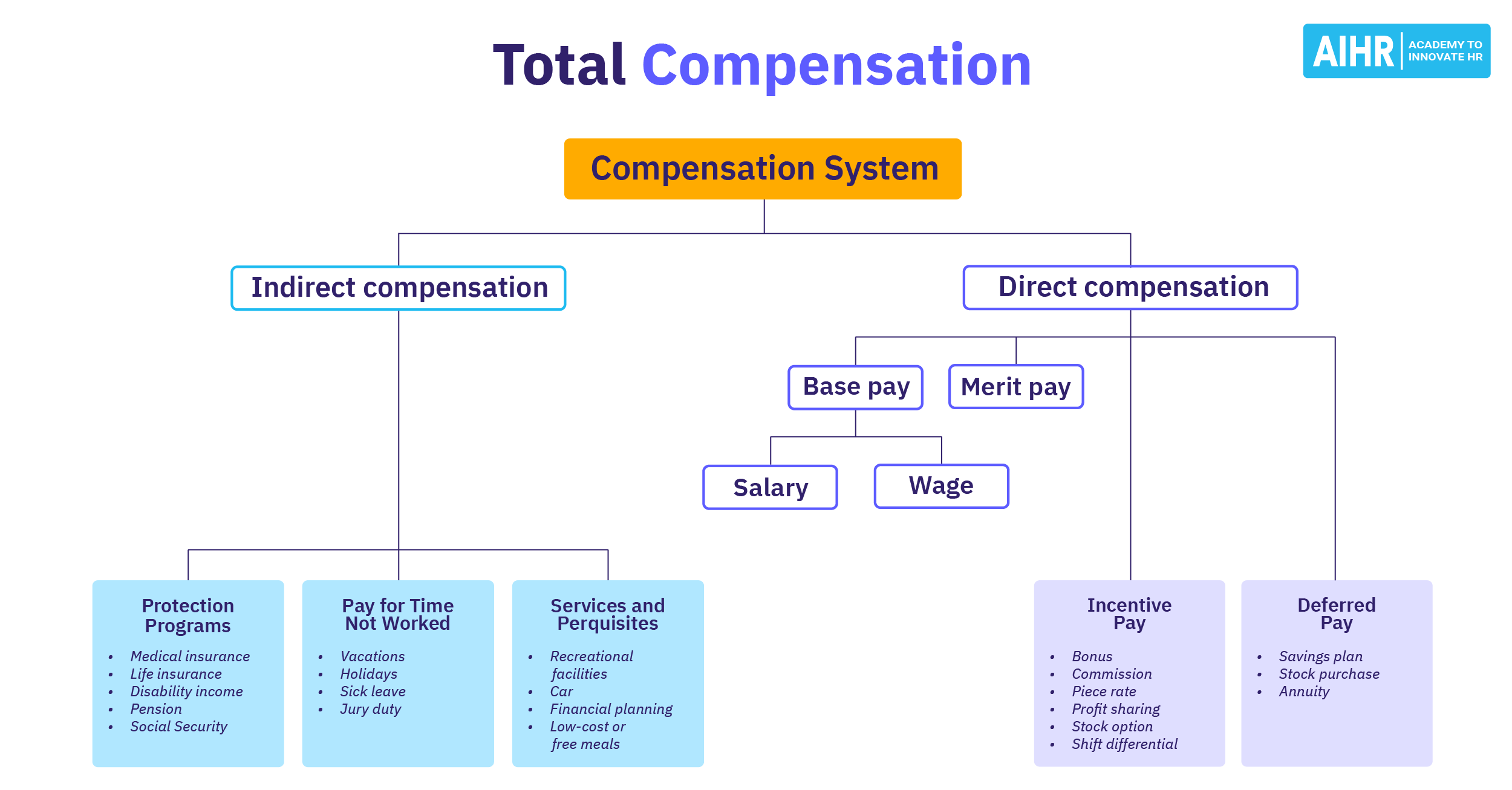

Supplemental pay refers to any additional payments employees receive on top of their regular wages. This can include bonuses, commissions, overtime pay, severance packages, sick leave payouts, awards, and tips.

Unlike base salaries or hourly wages, these payments often serve as incentives, encouraging employees to perform at higher levels and achieve their job goals. While regular pay consists of an employee’s agreed-upon salary, the IRS classifies supplemental income separately for tax purposes, with specific guidelines and rates.

However, some earnings, like overtime and tips, may still be treated as part of regular wages. For HR professionals, incorporating supplemental pay into compensation strategies can enhance motivation and strengthen workplace culture.

Supplemental pay types

There are several supplemental pay examples, each serving different purposes in employee compensation. These are some of the most common ones:

- Commissions: Earnings based on sales or performance targets.

- Overtime pay: Compensation for hours worked beyond the employee’s standard schedule.

- Bonuses: Performance-based, sign-on, retention, and holiday bonuses.

- Vacation lump sum payments: Payouts for unused vacation days.

- Awards: Monetary rewards for achievements or recognition.

- Severance pay: Payments made to employees upon termination or layoffs.

- Reported tips: Tips received and declared by employees.

- Retroactive pay increase: Adjustments to previous wages due to salary increases.

- Back pay: Payments owed for past work due to errors, disputes, or legal settlements.

- Accumulated sick leave payments: Compensation for unused sick leave.

What does not qualify as supplemental pay?

Not all additional payments are considered part of supplemental wages. The following types of payments do not qualify:

- Regular wages: An employee’s base salary or hourly pay, including standard payroll earnings.

- Paid time off (PTO): PTO is compensation paid to an employee for time away from work, and is considered part of the employee’s income.

- Stipends: Stipends are usually fixed amounts given for specific purposes, such as travel, meals, or professional development, and may not be subject to payroll taxes the way wages are.

- Non-taxable fringe benefits: Perks like employer-paid health insurance, tuition assistance (within IRS limits), or company-provided cell phones used for business purposes.

- Equity compensation: Stock options, restricted stock units (RSUs), and other equity-based incentives, which are taxed differently.

Boost your compensation strategy with supplemental pay

Understand the structure and tax implications of supplemental pay so you can use it to motivate employees and drive performance.

AIHR’s Compensation and Benefits Certificate Program will teach you how to design competitive pay structures that boost retention, ensure compliance, and align with business goals.

What is the difference between regular pay and supplemental pay?

Supplemental pay and regular pay are both forms of employee compensation, but they are treated differently for tax purposes.

Definition

Earnings paid in addition to an employee’s base salary or hourly wage.

The base salary or hourly pay an employee earns for performing standard work duties.

Examples

Bonuses, commissions, overtime pay, severance pay, retroactive pay, awards, tips.

Hourly wages, salaries, PTO, vacation pay (as part of salary), standard payroll earnings.

Taxation

Often taxed at a flat rate (22% federal withholding in the U.S.) or combined with regular wages for taxation.

Subject to standard income tax withholding and payroll taxes.

Purpose

Acts as an incentive, reward, or additional compensation for specific circumstances.

Compensation for standard job responsibilities.

IRS classification

Classified separately from regular wages for taxation purposes.

Classified as regular taxable wages.

How is supplemental pay taxed?

The rate at which an employee’s supplemental pay is taxed depends on how much one earns. In the U.S., employees who receive more than $1 million in a tax year are subject to a 37% tax rate. Your employee might have already submitted a Form W-4 seeking exemption from income tax withholding, but the flat rate of 37% is still obligatory.

However, if your employee hasn’t made more than $1 million in supplemental pay throughout a tax year, two conditions can be applied to the calculations:

- If the employee’s supplemental and regular wages are combined and the amount is unspecified, you can refer to the employee’s Form W-4 to make the federal tax withholding.

- In cases where your employee’s supplemental pay is separate from the regular wage, a flat tax fee of 22% is applied.

In the case of PTO and vacation pay, they are considered part of supplemental income when paid as part of your employees’ normal income. Normally, PTO and vacation pay are just replacements for your employees’ regular earnings when they aren’t present at work.

HR tip

Supplemental pay can be a sensitive issue, so provide employees with transparent and timely communication about it. Inform them about the criteria for receiving supplemental pay, such as meeting specific performance metrics, and communicate any changes in supplemental pay policies in advance.

What should HR consider in terms of supplemental pay?

HR practitioners and leaders should understand the impact of supplemental pay on employee motivation, financial planning, and compliance. Key considerations include:

- Supplemental wages, such as bonuses and commissions, can be powerful incentives to boost performance and retention

- Employers must follow federal and state tax withholding rules to remain compliant and avoid penalties, as these earnings are often taxed differently from base salaries

- HR should collaborate with finance teams to ensure pay structures align with company budgets and long-term financial goals

- Some forms of extra compensation, like overtime and severance, may have specific legal requirements at the federal and state levels, making it essential to stay informed about labor laws

- Partnering with finance, payroll, and legal professionals helps HR manage compliance, refine compensation strategies, and address employee concerns effectively.

FAQ

Supplemental pay refers to earnings an employee receives in addition to their base salary or hourly wage, such as bonuses, commissions, and overtime pay.

A year-end bonus, commission from sales, or overtime pay are common examples of supplemental pay.

Base pay is an employee’s fixed salary or hourly wage, while supplemental pay includes additional earnings like bonuses, overtime, and severance pay, which are not part of regular wages.

Supplemental wages are often subject to a flat federal withholding rate of 22% (or 37% if total supplemental earnings exceed $1 million), which may differ from regular wage tax rates based on an employee’s Form W-4.